RSA Tax Related Changes

When you updating to Release 5.4a, the new Tax Rates were applied retrospectively to 1 March 2020, according to the Budget Speech by the Minister of Finance on 26 February 2020.

If you updated after the first pay period to which the new Tax Rates apply, the Tax has been recalculated as from the first pay period in March 2020, and the change has been applied in the period in which you updated.

If you updated after March, the Medical Scheme Fees Tax Credits have not been backdated. These employees will be allowed to claim any possible benefits on assessment or you can correct this in one of two ways:

• Manually, by entering a value in the ‘Beneficiary Adjustment’ field for the previous month(s) on the Employee MHS Screen, to force a recalculation. Remember to remove this again to reflect employee’s actual beneficiary tally.

• Globally, with the assistance from your Sage Support team, by backdating beneficiaries on the ML Screen. You will need to edit employees who had a valid change to their Medical Aid Beneficiary tally in the current month, because this will now be incorrect for the previous month(s).

You can view the Statutory Rates of Tax by clicking on the <Tax Rates> button on any Employee’s Tax Screen or on the Basic Company Information Screen.

The new Tax Deduction Tables will also be applied to R.S.A. Dormant Companies that are in the 2020/2021 Tax Year.

Where the recipient is obliged to spend at least one night away from his/her usual place of residence in South Africa, an amount equal to the following is deemed to have been expended for each day or part of a day for:

• meals and incidental costs, R452;

• incidental costs only, R139.

The rates for foreign travel will be gazetted soon and can be found on www.sars.gov.za.

Prescribed Rate for Reimbursive Kilometres

The SARS prescribed rate per kilometre increased from R3.61 to R3.98.

If you have already entered Travel Transactions before updating to the current release, the rate per kilometer will have been calculated at R3.61/km.

Delete these transactions and recapture them to apply R3.98/km.

The Taxation Laws Amendment Act, 2019 was published on 15 January 2020.

The changes to ETI below are effective from 1 August 2019 and must be backdated accordingly.

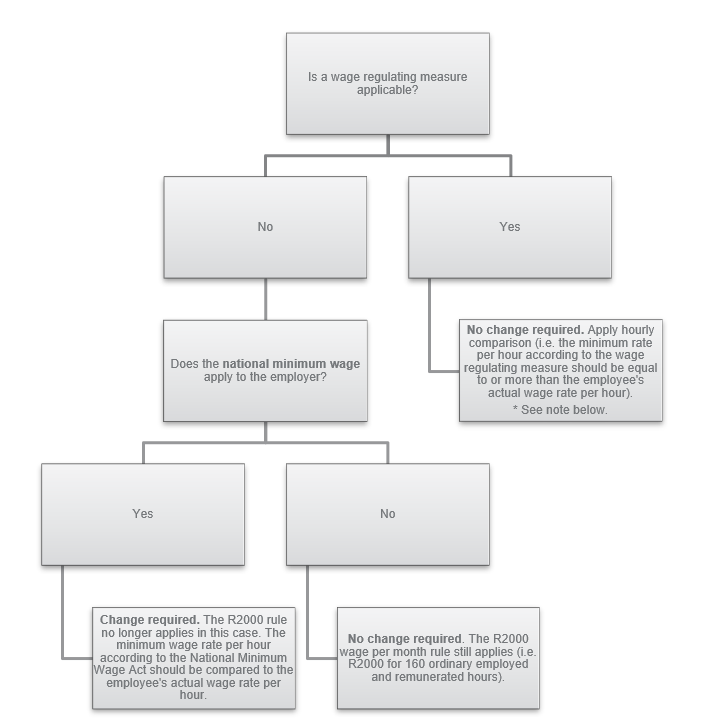

For an employee to qualify for ETI, he/she must be paid at least the minimum wage (amongst other qualifying criteria, which is not changed by this amendment).

If he/she is not paid at least the minimum wage he/she must be excluded from ETI.

Before 1 August 2019, an employee could have qualified if he/she was paid:

• the minimum wage according to the wage regulating measure, or

• if no wage regulating measure was applicable, R2000 per month for 160 employed and remunerated hours.

From 1 August 2019, to align the ETI Act with the National Minimum Wage Act, the minimum wage requirements to possibly qualify for ETI were changed to:

the higher of -

• the national minimum wage (R20 per hour, R18 per hour for farm workers, R15 for domestic workers, R11 per hour for workers employed in a public works programme and the minimum weekly learnership allowance for learners), or

• the minimum wage according to the wage regulating measure (sectoral determination, bargaining council agreement or collective agreement).

If none of the above is applicable (for example the employer is exempt from the national minimum wage after successful application and there is no wage regulating measure), then the R2000 wage per month for 160 ordinary employed and remunerated hours should be used as the minimum wage.

The National Minimum Wage Act takes precedence over any wage regulating measure.

Therefore, each bargaining council agreement, sectoral determination and collective agreement had to be updated with the correct minimum wages to be at least equal to or more than the national minimum wage.

It is the employer’s responsibility to confirm that the minimum wage according to the wage regulating measure is at least the minimum wage and this comparison will not be a change in the system.

If the employee was/is not paid at least the minimum wage, then the employee must not qualify for ETI and backdated corrections must be made (if applicable).

This will only apply to employees who do not belong to a wage regulating measure and who are not exempt from the national minimum wage.

This step must be actioned for Tax Year 2019 – 2020 and for Tax Year 2020 – 2021.

Make a backup before changing any information on the payroll.

Step 1: Change the ETI Setup on Company Level.

Company > Basic Company Information > Employment Tax Incentive Tab

Tick the relevant field to indicate where Rate Per Hour must be stored (this change is required, although the employees do not belong to a wage regulating measure, to ensure a rate per hour comparison is applied).

Step 2: Ensure that the Rate Per Hour is correctly captured for each employee based on the setting made in step 1.

Step 3: Amend or add the Minimum Wage Code.

Payroll > Definitions > System Description Codes > ETI Codes > Minimum Wage

Add a new code or select and amend the existing code to the applicable National Minimum Wage Rate Per Hour

(R20 per hour, R18 per hour for farm workers, R15 per hour for domestic workers, R11 per hour for workers employed in the public works programme and the minimum rate per hour for learners).

Step 4: Link all employees to the applicable National Minimum Wage Rate Code set up in step 3.

Use the Global Activation function to link all or groups of employees.

Payroll > Global Activation > ETI > Employee Tax Incentive Description

Step 5: Tick the Wage Regulating Measure option for the employee

This change is required, although the employee does not belong to a wage regulating measure, to ensure a rate per hour comparison is applied.

Use the Global Activation function to link all or groups of employees.

Payroll < Global Activation > ETI > Wage Regulating Measure

This will only apply to employees who do not belong to a wage regulating measure and who are not exempt from the national minimum wage.

The following steps must be performed in your Tax Year 2019 - 2020. For continuity, you can repeat them in your Tax Year 2020 - 2021.

Step 1: Export the ETI History Information for 2019 and 2020

• Interfaces > Export Data > ETI History

• Select to export the relevant year (for TAX 2020, you will need to do an export for 2019 and one for 2020).

• Click on Export

• Select Yes to save the file in Excel.

• Depending on your Browser settings, the file will either download automatically or follow the screen prompts to download the file.

• Excel will open when you click on the file.

• The Excel template will populate with the ETI data.

Step 2: Filter data based on the month

For 2019: Month 8 – 12 should be taken into account

For 2020: Month 1 up to the current month number should be taken into account.

Step 3: Compare the ETI Minimum Wage Value

Apply a calculation by dividing the ‘Actual Wage’ (column O) by the ‘Wage Hrs’ (column AC) to calculate a rate per hour.

Ensure the answer is at least equal to or more than the applicable national minimum wage rate per hour applicable from August 2019 to February 2020 (i.e. the rates before the increase effective March 2020, which were R20 per hour, R18 per hour for farm workers, R15 per hour for domestic workers, R11 per hour for workers employed in the public works programme and the minimum weekly allowance for learners).

• If the answer is less than the applicable national minimum wage rate per hour, amend the ETI value on the spreadsheet to be 0.00.

• If the answer is equal to or more than the applicable national minimum wage rate per hour, no changes are required.

Step 4: Review the ETI Period and Sets and correct where needed

This step must be actioned in Tax Year 2019 – 2020 and Tax Year 2020 - 2021.

Please Note: If you make changes to the ETI Set and Period, all subsequent months (and values where applicable) should be amended.

Step 5: Finalise the Import File

• Delete transactions that you don’t want to import.

• Delete columns AE (New/Term Days) to AL (Comment).

• Save file as an Excel Spreadsheet.

• Save the file again, but this time Select "Save As", enter a file name, and change the file type to CSV comma delimited (to be in the correct import format).

Step 6: Make a Backup (advisable) before we import the data

Step 7: Import the File

• Interfaces > Import Data > Utility Imports > ETI Take-on

• Select Import

• Select the folder where you saved the CSV file and enter the file name

• Click on Import

Step 8: Restate EMP201/EMP501 declarations where needed and make shortfall payments to SARS.

EMP201 for August can’t be restated. EMP501 will have to be resubmitted for March 2019 – Aug 2019 once the shortfall payment has been made to SARS.

These corrections can result in late payment penalties and interest.

It is important that the total 4118 value (ETI value on the tax certificate of each employee) balances back to the total ETI calculated value declared on the EMP201s/EMP501 for the employer to be able to submit their EMP501 reconciliation.

Please contact SARS for any assistance in revising the EMP201s/EMP501.

The Minister of Employment and Labour published Government Gazette 43026 on 17 February 2020. What follows are the changes effective 1 March 2020:

Effective 1 March 2020, the national minimum wage rates will increase:

• from R20 to R20.76 per hour,

• from R18 to R18.68 per hour for farm workers,

• from R15 to R15.57 for per hour domestic workers,

• from R11 to R11.42 per hour for workers employed on expanded public works programme, and

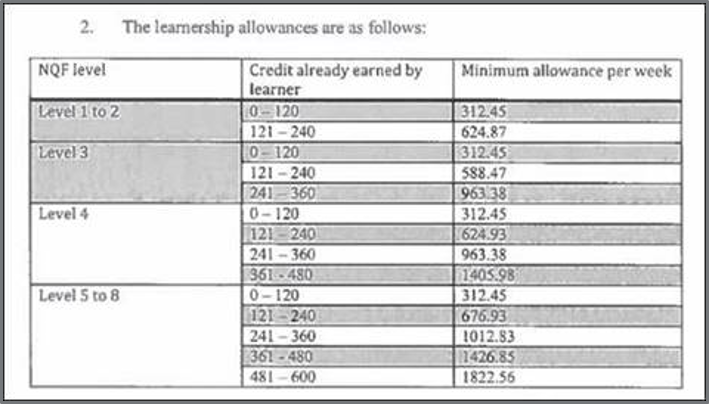

• to the table in Schedule 2 for workers who have concluded learnership agreements contemplated in section 17 of the Skills Development Levies Act (please see extract below).

Amend or Add the Minimum Wage Code in your Payroll

This step must be actioned for Tax Year 2020 – 2021.

If you are already in a processing month after March, you will need to backdate these values until March.

You can follow the steps here.

Payroll > Definitions > System Description Codes > ETI > Minimum Wage

Add a new code or select and amend the existing code to the applicable national minimum wage rate per hour, as specified above.

Important notes to take into consideration with the increase of the national minimum wage rates effective 1 March 2020:

• The national minimum wage takes precedence over any contrary provision in any contract, collective agreement, sectoral determination or law, except a law amending the National Minimum Wage Act. The national minimum wage must constitute a term of the worker’s contract except to the extent that the contract, collective agreement of law provides a wage that is more favourable to the worker.

• Therefore, the below sectoral determinations are being updated effective 1 March 2020 with wages at least equal to or more than the new national minimum wage rates (refer to Sectoral Determination 1 and 9 below).

• Any other wage agreement (including bargaining councils and collective agreements) must be updated effective 1 March 2020 to be at least equal to or more than the new national minimum wage rates.

• For ETI purposes, effective 1 March 2020, if a wage regulating measure is applicable to an employee (collective agreement, bargaining council or sectoral determination) and the minimum rates according to the wage regulating measure is less than the new national minimum wage rates, and the employee is paid the minimum wage according to the wage regulating measure then the employee should not qualify for ETI.

• To pass the ‘minimum wage test for ETI purposes’, the employee should be paid the higher of -

- the applicable minimum wage rate per hour according to the National Minimum Wage Act, or

- the applicable minimum wage rate per hour according to the wage regulating measure.

If none of the above is applicable (i.e. no wage regulating measure and the employer is exempt from the national minimum wage after successful application), then the R2000 wage per month for 160 ordinary employed and remunerated hours must be used.

Therefore, the employer must ensure that the minimum wage which is applicable to the employee is correctly indicated on the system. In other words, the employer must update/change the minimum wage on the system if applicable to prevent employees from qualifying for ETI if they are not supposed to qualify based on the new national minimum wage rates.

- If the employer pays less than the national minimum wage but equal to or more than the minimum wage specified in the wage regulating measure, then the employee must not qualify. To ensure the employee does not qualify, the employer must ensure the minimum wage on the system is the national minimum wage rate as indicated above.

- If the employer pays at least the minimum wage as per the wage regulating measure, and those rates are equal to or more than the national minimum wage rate, then the employer must indicate the wage rates as per the wage regulating measure as the employee should only qualify if the employer pays at least the minimum wage rates as per the wage regulating measure.

- If no wage regulating measure is applicable and the employer is exempt from paying the national minimum wage, then a minimum wage of R2 000 per month is still applicable. For these employees, it must be indicated that no regulating measure is applicable for the system to apply R2 000 as the minimum wage.

If an employer cannot afford to pay the national minimum wage, then the employer can apply for exemption from the National Minimum Wage Act. Please refer the client to the online application system https://nmw.labour.gov.za/ for more information.

Effective 1 March 2020, employers should pay the minimum wages as contained in the Schedule (please refer to Government Gazette 43026 to view the rates).

Effective 1 March 2020, tables 1 and 2 contained in Government Gazette 42766 of 14 October 2019 should be replaced with table 1 and 2 contained in the Schedule (please refer to Government Gazette 43026 to view the rates).

• BCEA 1: Summary to be kept by an employer in terms of section 30 of the BCEA (summary of the BCEA to be kept at the workplace where it can be read by employees).

• BCEA 9: Written undertaking by the employer.

• BCEA 12: Compliance order issued in terms of section 69(1) of the BCEA.

• BCEA 14A and 14B: Certificate of appointment in terms of section 63 of the BCEA.

Please refer to Government Gazette 43026 for more information.

Before 1 March 2020: certain remuneration paid/accrued to a resident employee by any employer (of private sector companies only) in respect of employment services rendered for or on behalf of the employer in any country outside South Africa was exempt from PAYE/income tax if -

• the employee was outside South Africa for a period (or periods) exceeding 183 full days in any 12 months, and

• for a continuous period exceeding 60 full days in total in that period of 12 months.

From 1 March 2020: Certain remuneration paid/accrued to a resident employee by any employer (of private sector companies only) in respect of employment services rendered for or on behalf of the employer in any country outside South Africa is exempt from PAYE if –

• that certain remuneration does not exceed one million rand for the tax year, and

• the employee is outside South Africa for a period (or periods) exceeding 183 full days in any 12 months, and

• for a continuous period exceeding 60 full days in total in that period of 12 months.

During the 2020 budget speech, the Minister of Finance announced an increase in the exemption limit to R1.25 million per tax year effective 1 March 2020.

The increase in the exemption limit has not been promulgated.

SARS published an FAQ document and a new Interpretation Note 16 to assist employees and employers to obtain clarity on certain practical and technical aspects relating to this amendment.

Resident employees who render services outside of South Africa often find themselves in a predicament regarding their tax affairs since a double tax situation may arise.

In this case, the employer may (at his/her own discretion) apply for a different basis to calculate the amount of employees’ tax to be withheld from the employee’s remuneration, taking into account the potential foreign tax credit which may be claimed on assessment.

The employer will apply for a directive (IRP3(q)).

This is not the actual granting of the section 6quat credit and the employee is still required to submit an income tax return in which the actual foreign tax credit under section 6quat must be claimed.

For more information regarding the directive application, please click here.

The system will not apply the exemption automatically due to numerous variables to be considered by employers, for example the qualifying periods, employment at more than one employer during the tax year, amounts paid/benefits received by foreign employer etc. It is the user’s responsibility to apply the foreign employment exemption on the payroll and report against the relevant IRP5 code.

Step 1:

If the employee is working outside RSA for or on behalf of the employer, determine whether the employee qualifies for the foreign employment income exemption according to the days rules (i.e. outside South Africa for a period (or periods) exceeding 183 full days in any 12 months and for a continuous period exceeding 60 full days in total in that period of 12 months), if yes continue to step 2.

If no, remuneration for services rendered outside RSA for or on behalf of the employer is still loaded on an employee record flagged for foreign income (to ensure it is reported on foreign employment income IRP5 codes), but with a normal taxable tax status (for example Statutory Tables) and the remuneration is subject to PAYE, UIF (unless a specific UIF exemption reason is applicable, for example Temporary) and SDL.

Step 2:

Determine if the remuneration received for services rendered outside RSA for or on behalf of the employer is within the exemption limit. If yes, continue to step 3.

If the foreign employment income exceeds the exemption limit, continue to step 4.

Step 3:

This exempt foreign employment income is loaded on an employee record flagged for foreign income (to ensure it is reported on foreign employment income IRP5 codes), and with a tax status set to No Tax.

The remuneration is not subject to PAYE, UIF and SDL.

Step 4:

As soon as the exemption limit is exceeded, the remuneration should be subject to PAYE, UIF and SDL.

This remuneration is still loaded on a record flagged for foreign income (to ensure it is reported on foreign employment income IRP5 codes), but with a normal taxable tax status (for example Statutory Tables) and the remuneration is subject to PAYE, UIF (unless a specific UIF exemption reason is applicable, for example Temporary) and SDL.

• Terminate the exempt foreign employment income record referred to in step 3.

• Create a new record with a new IRP5 start date.

• Select the relevant tax status to calculate PAYE (for example Statutory Tables).

• UIF and SDL should calculate for this record (unless a specific UIF exemption reason is applicable, for example Temporary).

• Routing entry field: Type FI. A message will display asking whether you want to Flag this employee for Foreign Income, select <Yes>. FI will display in brackets next to the Tax Status label.

• The foreign employment income exceeding the exemption limit should be processed on this record.

If the limit is reached in the middle of the month, income must be split between the exempt and taxable records (refer to step 3 and 4 above).

If the employee returns to RSA to perform services in RSA for or on behalf of the employer, the remuneration should be processed on a new record with normal IRP5 codes (not flagged for foreign income) and must be subject to PAYE, UIF and SDL.

The fringe benefits interest-free or low-interest loan (official rate) is 7.25% p.a.

This remains unchanged at R500 000.00.

The value of “B” has been amended to the new tax threshold of R83 100, however, this has not yet been promulgated.

According to section 7A of the Income Tax Act, the amount of salary (excluding any bonus) which becomes payable to a person under a permanent grant made with retrospective effect, of a salary or of an increase in a salary, and which in terms of such grant is payable in respect of a period ending on or before the date on which the grant has become effective is known as backdated salaries/antedated salaries (i.e. back pay).

Backdated salaries (back pay) may relate to current and prior tax years.

According to paragraph 9(3) of the Fourth Schedule to the Income Tax Act, employers must apply for a directive to establish the amount of PAYE to be withheld from a lumpsum contemplated in section 7A.

Effective 1 March 2020, employers must apply for a directive in order to establish the PAYE amount to be withheld from back pay that relates to prior tax years. Back pay that relates to prior tax years must be reported against IRP5 code 3907 and the tax according to the directive against IRP5 code 4102.

The employer will apply for a directive using an IRP3(a) form.

There is no change to back pay that relates to the current tax year, this must still be reported and taxed against IRP5 code 3601.